Using Net Promoter Score for Financial Services

Do you have your finger on the pulse of your customers’ feelings toward your bank? Net Promoter Score® (NPS) is a popular tool in sentiment analysis, or the process of understanding customer attitudes and responding appropriately. In the financial services industry, consumers have many choices for deposit accounts, mortgages, investment accounts, and more. If you’re not soliciting customer feedback, you risk losing frustrated or neutral customers to a competitor. At PrintMail, we use NPS to gauge customer satisfaction and feedback. Whether your bank is already using NPS or just considering it, this article will help you make the most of net promoter scores for banks so you can hold onto existing customers while growing with new ones.

What is NPS?

Net Promoter Score® (NPS) is a simple and effective way to assess customer satisfaction and an organization’s potential for growth. It consists of just one question:

On a scale of 0-10, with 10 being the highest, what’s the likelihood that you would recommend us (our bank) to a friend or colleague?

Since its 2003 debut, NPS has been used by companies of all sizes in a variety of industries. Its effectiveness comes from its ability to measure the overall satisfaction of a customer base. Many companies include a feedback box for respondents to elaborate on their rating if they wish to do so.

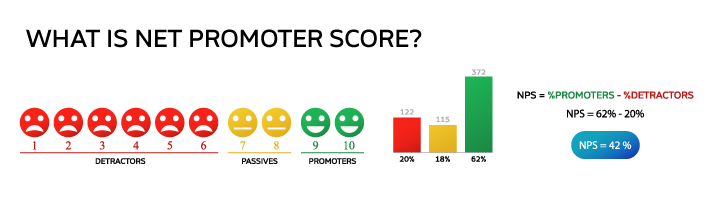

To calculate your NPS score, divide the responses you collect into 3 categories:

- Promoters are the customers who answer with a 9 or 10. They are the most loyal of your customers whose enthusiasm for your brand translates into actual recommendations to family and friends.

- Passives are comprised of people who answer with a 7 or 8. They are largely indifferent to your organization, disinclined to share either negative or positive reviews with others.

- Detractors answer the question with a 6 or lower. These unsatisfied customers could actively harm your brand by making their complaints public.

Count the number of promoters and detractors you’ve identified from the total number of respondents. Calculate the percentage of each and subtract the percentage of detractors from the percentage of promoters. (Passives get left out of the NPS calculation because they are unlikely to recommend or not recommend you.) The resulting number, whether positive or negative, is your NPS score.

Industry Average NPS Benchmarks for Banks

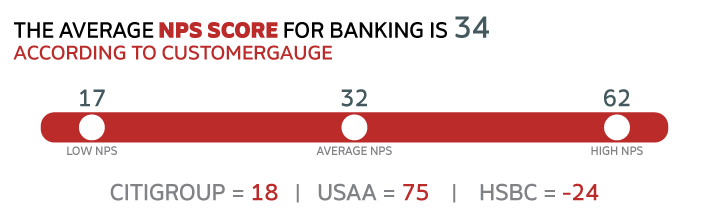

According to CustomerGauge, the average NPS score for banking and financial services is 34. As you can see from the same article, it’s possible to have a very high score of 75, in the case of USAA bank, as well as a negative score of -24, as with HSBC. One additional study from Celent found that within the banking industry, large banks averaged an NPS of 12, while community banks and credit unions averaged a 47. The takeaway is that investing in turning more of your customers into promoters will pay off in the long run.

How to Use NPS

First, you need to decide what kind of data you wish to collect. For example, will you split customers into groups according to Personal or Business Banking, Mortgage Loans, or Consumer Lending? Also, do you want to evaluate specific branches and loan officers? The answers to these questions will shape your approach to your bank net promoter score strategy.

Next, you need to choose a vendor to implement and collect NPS survey results. There are plenty to choose from, but here are a few examples:

Next, you need to choose a vendor to implement and collect NPS survey results. There are plenty to choose from, but here are a few examples:

- Customer Service Profiles: NPS is one of several metrics they collect for a “Customer Experience Analysis.”

- Cvent: Offers online survey software that could be used to collect NPS data.

- ForeSee: The CX Suite includes NPS collection.

- Qualtrics: Offers their own Net Promoter Score Software.

- SurveyMonkey CX: a “turn-key” NPS solution

Finally, what will you do with the results of your NPS surveys? For example, if your score is good, will you share it publicly as a way of highlighting your bank’s positive record on customer service? How many people/departments will have internal access to NPS scores? Will you establish a process for responding to negative comments by reaching out to customers over phone or email? Some banks also attach NPS scores to manager compensation.

Why should banks care about NPS?

In an increasingly competitive banking climate, customer loyalty is more important than ever. As traditional community banks face challenges from fintech companies and online-only banks, they need to make sure their existing customer base won’t be lured away by the latest shiny new app. Of course, banks also need to grow. Customer loyalty is an important indication that they’re on the right track.

When you consider the cost of customer acquisition, it’s much cheaper to acquire a new customer through an enthusiastic word-of-mouth recommendation than to spend money on marketing and promotions. Of course, you’re never going to find all of your new customers through your Promoters, but those loyal customers are a definite asset to your marketing department.

Case Study #1: How Fidelity Bank Uses the NPS Score

To glean insight into the way banks use NPS, we spoke to Joann Marsili, CFMP, Senior Vice President and Director of Marketing and Digital Sales at Fidelity Bank (which is also a PrintMail customer) in Scranton, PA. Fidelity started using NPS at the end of 2017. They send out 4 NPS surveys each month, at different times of the month: Retail Experience, Business Experience, Mortgage/Home Equity, and Consumer Loans. Then, NPS scores are calculated for each Fidelity branch and individual mortgage officer. The results are shared internally with senior management and every branch and loan officer receives their score. Fidelity also has a process in place to call any customer who leaves a negative response in hopes of resolving the issue.

Although NPS is still relatively new for Fidelity, Marsili says it helped the bank made positive changes almost immediately. After receiving a lot of data that customers were growing impatient with long wait times at the drive-ups, Fidelity looked into the situation and figured out how to improve it. Now the wait times at the drive-up are much shorter.

Feedback on NPS surveys also helped Fidelity identify an educational opportunity: customers were unaware of the bank’s mobile tools. Whenever someone left a comment along the lines of, “I wish I could deposit a check remotely like at the big banks,” Fidelity called the customer to inform them of the remote deposit feature within Fidelity’s mobile app.

If you’re ready to implement NPS at your bank but need internal buy-in, Marsili has this advice:

“How do you know you’re executing on [your Model Experience] if you don’t survey your customers? We’re not hearing the problems if we don’t survey.”

Without a way to capture and resolve negative feedback, Marsili says, a frustrated customer is likely to leave. “Focusing on retention is just as important as acquisition, especially for a community bank.”

Case Study #2: How Fidelity Bank Uses the NPS Score

We also talked to Doug McGregor, Vice President of Marketing at First Federal Bank of Kansas City. Like Fidelity, First Federal Bank of Kansas City’s inclusion of the Net Promoter Score® in its Customer Satisfaction Surveys is fairly recent: they’ve been using NPS for about 18 months. McGregor told us that his bank sends an email survey once a week to every new customer who opened an account the previous week. The results are tracked by banking center. First Federal Bank of Kansas City also sends a customer satisfaction survey (including NPS) to every new mortgage customer the day after their loan closes. All of these results are shared with senior management and the board each month. McGregor said they haven’t been collecting data long enough to tie NPS scores to performance goals, but they do plan to start at some point.

Whenever a customer leaves a negative comment, the survey is sent to the regional manager to follow up on. Overall, McGregor thinks that tracking NPS “makes everybody more aware that every interaction you have with a customer is an opportunity to really provide an excellent experience.” His advice for anyone trying to implement NPS at their bank is:

“If it’s not measured, it’s not happening. Financial Services is a very data-driven field. We can’t rely on anecdotal evidence in the age of Amazon online reviews. We need to have our finger on the pulse of what the customer is really thinking and NPS is an easy way to do that.”

5 Tips for Improving Your NPS Score

Any NPS score higher than 0 is generally considered good, but if you’d like to raise yours to the industry average of 34 or higher, these tips can help you get there.

- Just as Fidelity Bank did with drive-up wait times, make the changes your customers want to see. Often, bank customers want their experience to be simpler or more convenient. They also seek more opportunities to do things digitally, especially younger generations. For example, a recent BAI Banking Outlook study found that a majority of millennials would switch banks to get better apps and digital capabilities.

- Don’t get carried away with bells and whistles, though. When it comes to digital, your top priority should be to make your bank website and mobile app as multifunctional and convenient to use as possible.

- Think about promoters and detractors differently. Usually, the action you take to appease detractors won’t be the same thing that turns more of your neutral customers into promoters. Analyze these groups separately and come up with unique solutions for each.

- Educate customers on the benefits you already offer. Are you in the situation Fidelity Bank was in, with customers asking for digital options you already offer? Get the word out about all the great features your bank already provides. Let them know you offer the same modern tools as the big banks, but with a friendlier, local touch.

- Get all of your employees involved in boosting NPS. Just as NPS scores can be tied to management compensation, your bank could also develop incentives for branch staff to aid in the companywide effort to raise NPS. This is especially easy to do if you track individual branches’ NPS. For example, the branch with the highest NPS after a certain period of time wins a pizza party or an Amazon gift card for each staff member.

Partner with PrintMail Solutions

PrintMail has long been an industry leader in innovation, customer satisfaction, and security. As we continually invest in improving the experience of our customers, we’ve seen a corresponding increase in our NPS; +23 points last year and +12 points so far this year. How do we do it? It all comes down to a willingness to listen with discernment and react accordingly. We can partner with your bank to improve the processes and services your customers are unhappy with. From statement processing and integrated eStatements to mail and digital marketing services, we can help you educate customers and give them a simpler, more convenient experience. Contact us today for a free quote.