Using Storytelling to Market and Sell Insurance

For thousands of years, humans have communicated through storytelling. From ancient drawings to oral tradition and written text, storytelling is intrinsic to human communication and connection. Fast forward to the present day when consumers are inundated with complex, impersonal jargon from companies looking to sell their products and services. With storytelling deeply embedded in our DNA, it’s not surprising that this less personal, less compelling method of selling and advertising is inefficient. Your insurance brand can use powerful stories in your sales and marketing campaigns to differentiate you from your competitors, create unmatched brand loyalty, and build trust and credibility with your customers.

What is emotional storytelling?

This style of writing uses certain word choices, examples, and stories to evoke an emotional response in the reader. For example, a piece of marketing content for life insurance might aim to evoke emotions of concern for loved ones. From there, the natural solution for the reader is to find the right life insurance policy that will take care of your family in the event of your untimely death.

Now that you understand the concept of emotional storytelling, let’s look at how you can incorporate this approach in your marketing content.

Make an emotional connection.

First and foremost, storytelling gives you an opportunity to emotionally connect with current and prospective customers. Emotional connection is at the heart of all successful sales and marketing efforts. Connecting with consumers on an emotional level helps consumers see your brand as a collection of people with a mission of helping them, rather than a business entity, void of all feelings and empathy. Humanize your brand.

Insurance products are a great fit for emotional storytelling because insurance is inherently personal. From car and home insurance to health insurance, life insurance, disability, and more, insurance policies exist to help and protect people in the event of some of life’s worst-case scenarios.

For example, check out this list of “10 Best Insurance Commercials” for some fantastic examples of the power of emotional storytelling in advertising.

Define your purpose.

When you incorporate storytelling into your marketing campaigns, don’t limit yourself to narratives about your customers and their challenges. You should also tell stories about your insurance agency’s history, values, and–perhaps most importantly–your purpose. This type of marketing can help your existing and prospective customers develop an emotional connection with your brand.

Purpose-driven marketing:

If you’re scratching your head to find the true “purpose” of your company, think about the reason your organization set out to provide insurance products and services in the first place (beyond making money). Who do you want to help? What problem in the world do you want to solve? How are you involved with the communities you serve? Look beyond what products you offer and dig deep. Ponder exactly how your insurance brand changes people’s lives for the better–that is your brand purpose.

For example, this list of “11 Best Brand Stories” shows you how big names like Apple, Ikea, Google, and more have done it.

Build trust and credibility.

To attract new customers and build trust with your audience, authenticity matters. Avoid fabricating or “enhancing” a story–today’s savvy consumers can see right through unauthentic content. That’s why the truest stories are also the most impactful. According to a Khoros study, 38% of customers say that if a company is authentic and genuine in their interactions, they are more likely to feel emotionally connected to the brand.

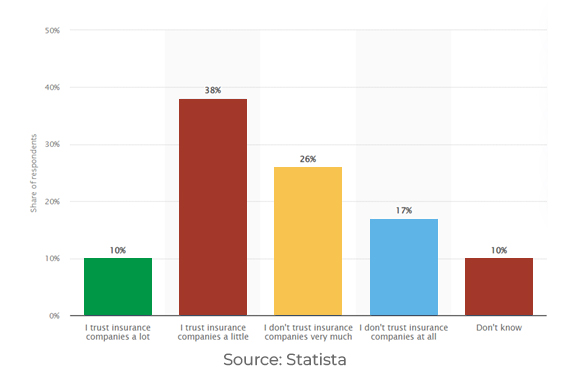

Building trust and authenticity is especially important in the insurance industry, where consumer trust is difficult to obtain and hold onto. For instance, a study by Statista revealed that only 10% of people “trust insurance companies a lot.” Therefore, establishing trust and credibility is paramount for obtaining customer loyalty.

One of the best ways to build trust and credibility in your insurance brand is to highlight customer testimonials and success stories. Interview satisfied customers about how your company has improved their quality of life. Promote their stories in your marketing efforts, from your commercials and advertising copy to your social media posts and blog content writing.

Success stories should also be shared with your sales team, and they should be encouraged to share these stories with prospects. A sales pitch without storytelling can come across as gimmicky or forced. Train your sales team to be master storytellers.

Simplify complex concepts.

Many insurance concepts are difficult for the average consumer to understand. Along with storytelling, you should be using your content to educate customers and prospects. You can simplify common insurance concepts, such as whole vs. term life insurance, by providing engaging, emotionally driven narratives to help explain these complex topics in a palatable way.

Storytelling can boost conversions by 30% when used to answer consumer questions. Through research and analytics, you can discover the questions your target audience has and then answer them in blog articles, social media posts, and more.

Use storytelling in marketing through images.

The saying “A picture is worth a thousand words” holds true in insurance marketing. One of the most powerful forms of storytelling is with a single image. You should put as much effort into choosing and creating your images and graphics as you do with written content.

Carefully select the photos and graphics you use for billboards, social media posts, paid advertisements, and other promotional materials. Good image curation can convey powerful messages to the consumer.

Learn more about storytelling in digital marketing for insurance companies!

Need help implementing the power of storytelling in your traditional and online insurance marketing campaigns? PrintMail Solutions specializes in providing communications and marketing solutions for insurance agencies and companies. Schedule a call with a team member and discover how PrintMail can grow your insurance brand’s communications and marketing efforts.