Email Marketing Best Practices For Insurance Agencies

Think email is dead? Far from it: email marketing is an incredibly effective way to reach your insurance company’s target audience and increase conversions. In fact, for every $1 spent on email marketing, businesses on average receive a $36 return. This is the highest return on investment (ROI) of all marketing forms. So, whether you haven’t tried email marketing yet, or you’re looking to improve on what you’ve already built, keep reading for six best practices to abide by when launching your insurance agency’s email marketing campaigns.

Implement Automations

Email marketing automation is the process of automatically sending emails to users based on certain actions. For example, you could implement an automation to send a Welcome email whenever someone signs up for an insurance policy. Or you can implement an automation to send out a New Blog Post notification to all email subscribers each time a new blog is posted on your website.

Email marketing automation streamlines the email process and allows you to expand your bandwidth, so you can reach more leads efficiently. PrintMail Solutions offers email marketing automation services for insurance agencies, helping to streamline communications and increase brand awareness (learn more about our digital marketing services for insurance agencies here).

Utilize Merge Variables

Merge variables create customized emails by inputting information about a lead, such as name or location, into the email. For example, a merge variable could say “Welcome Back, Marcus!” or “Best insurance rates in Philadelphia, PA”. “Marcus” and “Philadelphia, PA” are the variables that change based on the lead’s personal information.

Customizing your emails with merge variables creates more intimate, personalized content. The lead feels more connected to the brand, and less like they are a cog in the wheel of a 500,000 email address list. Since insurance is a personal product to sell, personalizing your emails can create a friendly, appealing tone that builds trust and connection.

Use Dynamic Content

Similar to merge variables, dynamic content is a way to customize emails based on lead information. Dynamic content changes depending on who the recipient of the email is. For example, leads in Pennsylvania receive an email with a Liberty Bell background image, while leads in New York receive the same email, but with a Statue of Liberty background image.

This is another way to personalize content and allow the recipient to feel more connected with your company. Building consumer trust in the insurance industry is difficult. Only 10% of consumers have significant trust in their insurance provider. Customized email content can help your brand increase customer loyalty and brand trust.

Clean Customer Lists

Having a clean email list is important because it helps you maintain a good IP Reputation. When your deliverability percentage increases, it shows an ISP that your email comes from a reliable sender. Your IP Reputation or IP Score is what email providers use to determine whether your email lands in a user’s general inbox or in their spam. The higher the IP Reputation, the more likely you’ll end up in the general inbox.

Websites like Zero Bounce provide email validation services to help determine which emails from your current list are legitimate and which ones are invalid. This process should be completed every few months to ensure your email list is as “clean” as possible.

Other tips to ensure your IP Reputation remains high:

- Avoid misspelling email addresses when inputting to the database.

- Avoid buying email addresses.

- Avoid low-quality content.

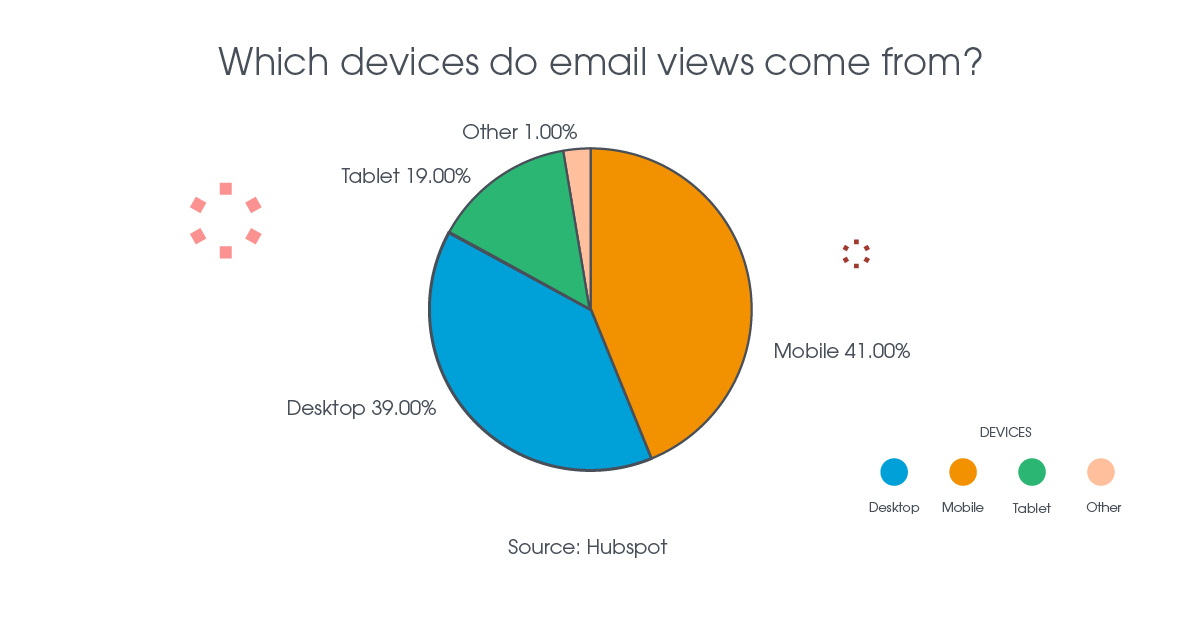

Optimize For Mobile Devices

Be sure to test emails on mobile devices to ensure they are optimized for mobile use. According to a HubSpot study, more email views now come from a mobile device than any other device. If your emails aren’t optimized for mobile, you’re losing out on the majority of your potential readers.

Best practices for optimizing email for mobile devices include:

- Keep subject lines under 40 characters.

- Make pre-header text succinct, clear, and punchy.

- Bring your CTA button to the top of the copy.

- Split up copy with frequent line breaks and short paragraphs so it’s easy to skim.

- Ensure your landing page is optimized for mobile as well.

Use Data To Optimize Future Campaigns

Just as you use data and analytics to track website traffic and gauge blog performance, you can and should use data to see how well your email campaigns are performing. This will help you optimize future campaigns.

Email split testing, also known as A/B testing, means creating two versions of the same email campaign and sending each version to a different sample group to test engagement. Whichever version gets the most opens and click-throughs is the winner, to be sent to the rest of your subscriber list. Seeing which types of subject lines, topics, graphics, etc. generate the most engagement will help you optimize future email campaigns.

The most common variables for A/B testing include:

- Subject lines

- Creatives/ Images

- Content length

- Style

- Word Order

- Dynamic content & merge variables

In addition to A/B testing within the same campaign, you should also conduct a cross-campaign analysis. This can show you what your customers are most interested in. For example, if the open rate for a life insurance policy email campaign is 5%, while the open rate for a car insurance policy campaign is 55%, it may be time to reevaluate life insurance offerings or focus resources more heavily on car insurance. Interpreting the data can help inform your future strategy.

Get help with your insurance email marketing campaign!

Does this all sound great, but your marketing resources are already stretched too thin? PrintMail Solutions specializes in email marketing automation solutions for insurance agencies. Speak to a Digital Marketing Strategist to learn about how PrintMail can help your insurance agency start or expand its email marketing capabilities. Contact us today!